A 73-year-old Erskine resident was almost left $300,000 out of pocket after he was targeted by an investment scam.

Create a free account to read this article

$0/

(min cost $0)

or signup to continue reading

Wanting to invest money he recently made on a house sale, Lang Baker went to google to look at his options.

He left his contact details on a website that claimed it would find him the best return on investment.

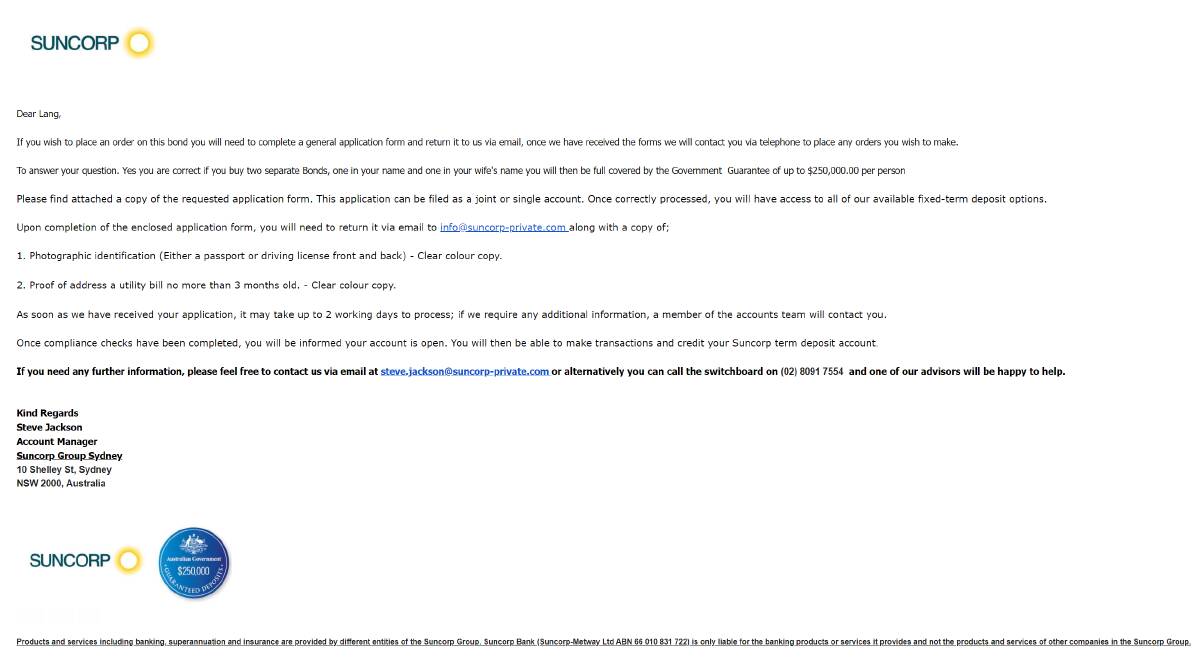

Soon after he received a call from a man called Steve Jackson claiming to be a manager at Suncorp.

"He emailed me an application form that requested a copy of my passport, date of birth, tax file number, a recent utility bill and driver's license," Mr Baker said.

"All of these things are normal to get enough points to open a bank account so it did not strike me as anything unusual."

A few days later, the scammer said Mr Baker's application had been approved and he would email the bank guarantees from Suncorp and details on where to deposit the money.

It was not until Mr Baker googled the BSB number he became suspicious.

"When I googled the BSB it came up with the Commonwealth Bank in Sydney and I thought that's a bit odd since he said he's from Suncorp," Mr Baker said.

"That prompted me to ring Suncorp and when I rang they told me it was an investment scam.

"If I had not made that one phone call, I would have lost $300,000."

Upon closer look, Mr Baker found out the manager of Suncorp was Steve Johnson not Jackson and the scammer used an email unlike those of legitimate Suncorp employees.

"After I discovered it was a scam I thought I will google again," Mr Baker said.

"The first ad that comes up on the computer says Westpac is offering seniors two per cent if you're over 65.

"I rang Westpac and it is another scam."

Read more:

The Australian Competition and Consumer Commission reported people lost over $27,000 to investment scams just in February, 2022.

If you are considering investing, always remember to:

- Check if a financial advisor is registered via the ASIC website.

- Check ASIC's list of companies you should not deal with. If the company that contacted you is on the list - do not deal with them. But even if they are not on the list it could still be a scam.

- Search for the company online plus "review", "complaint" or "scam".

The investment offer may be a scam if the person:

- does not have an Australian financial services (AFS) licence or says they don't need one

- constantly contacts you and pressures you to make a quick decision

- uses the name of a reputable organisation to gain credibility

- has an investment prospectus that isn't registered with ASIC

- offers you very high investment returns

If you spot any of these signs, hang up the phone or delete the email. If you manage to record any of the scammer's details, report them to the Australian Securities and Investments Commission