Treasurer Scott Morrison has defended tax changes announced in the May budget which will accommodate overseas sovereign wealth funds operating under Sharia law.

Create a free account to read this article

$0/

(min cost $0)

or signup to continue reading

Campaigning in Mandurah with Canning MP Andrew Hastie, Mr Morrison said the changes, which would allow Islamic financing transactions to be treated as loans for Australian tax purposes, were not intended to benefit investors from any particular country.

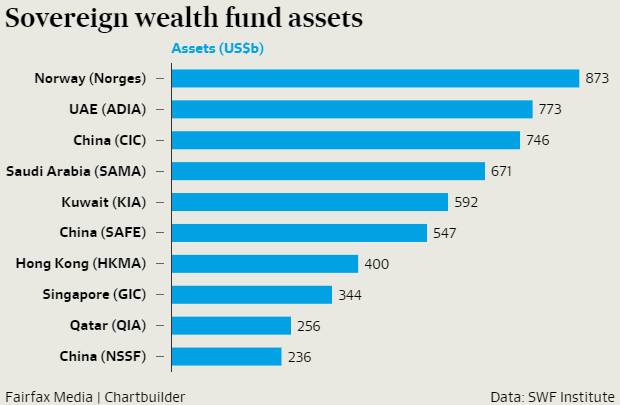

But five of the top 10 sovereign wealth funds in the world, including Kuwait’s and Saudi Arabia’s, operate under Sharia compliant financing arrangements and avoid buying Australian assets because it costs them too much in tax to borrow from Australian banks.

The changes announced in the budget will remove this impediment.

“We changed the asset backed financing arrangements which have nothing to do with Sharia law, it's about trying to have more flexible financing arrangements for infrastructure and this is things like changing the way hire purchase contracts work and infrastructure financing, deferred settlements and the way payments get paid in capital rather than interest,” he said.

“The need to change those asset backed financing arrangements has been around as in issue for infrastructure financing since I was writing about it 20 years ago,” he said.

However, he conceded the changes would benefit sovereign wealth funds from the middle east and encourage them to invest in Australian infrastructure and agricultural products.

Mr Hastie said foreign investment had been a concern for voters in his electorate and was a “recurring theme on the street”.

“What I'm picking up is that a lot of people, hard working Australians, who would identify with Bob Hawke and old Labor, they don't feel represented by the urban progressive elite that you find in the east coast cities like Sydney and Melbourne,” he said.

“So they come to us with these concerns about foreign ownership and the sale of ports.”

Mr Morrison said people wanted confidence the government was making decisions about foreign investment in Australia’s national interest.

He attempted to allay concerns that Fremantle’s port could be sold to a foreign government if the Premier Colin Barnett was successful in his privatisation attempt and said recent changes to foreign investment rules means any sale would be reviewed.

“If the Port of Fremantle was in that situation, then it would come through that FIRB [Foreign Investment Review Board] process,” he said.

Mr Morrison drew parallels between his approach to foreign investment and his experience as immigration minister.

“We all know foreign investment is really important to our development, just like immigration is incredibly important to the growth of the country and its social fabric, so these are things that are assets for the country and you have to protect their value and their support in the community,” he said.

“People just need to know that there is a set of rules, they're rules that are set up to protect our national interest and the people running them are going to make decisions in that interest.”

Mr Morrison said people who questioned foreign investment were not xenophobic.

“It's just practical and people have a good sense of national sovereignty and they reasonably expect that that will be respected by governments when they make decisions,” he said.

“I think that's fair enough.”

More from Mandurah Mail: Canning MP Andrew Hastie hits out at same-sex marriage plebiscite opponents